RECOMMENDATION OF THE UK CORPORATE GOVERNANCE CODE ON DIRECTORS COMPOSITION

An overview of the Companys compliance with the principles of the UK Corporate Governance Code applicable to the company during the financial year ended 30 September 2021 is set out in the Directors Report included in the latest annual report and accounts a copy of which can be found here and below. The code is published by the Financial Reporting Council FRC.

2020 Global And Regional Corporate Governance Trends

A42 All directors appointed to fill a casual vacancy should be subject to.

. The Malaysian Code on Corporate Governance Code first issued in March 2000 marked a significant milestone in corporate governance reform in Malaysia. The Board of Directors. The board and its.

Interested parties can communicate with the Chairman Independent Directors or the non-management directors by sending a letter addressed as follows. An explanation of how the Group has complied with the Code is set out below and also in the Audit Committee Report on pages 63 to 65 of the Companys 2021. Code Provisions A41 Non-executive directors should be appointed for a specific term subject to re-election.

At least one-third for listed companies that are controlled. For listed companies the UK Corporate Governance Code recommends that a nomination committee made up predominantly of independent non-executive directors should lead the process for board appointments ensure plans are in place for orderly succession to both the board and senior management positions and oversee the development of a diverse. The UK Corporate Governance Code requires a board to have three committees.

In the UK Corporate Governance Code the King IV Code and directive 42018 as issued by the South African Prudential Authority when considering the independence of the non-executive directors and follows a thorough process of assessing independence on an annual basis for each director. Recommendations on Corporate Governance and adjust them such that following an overall assessment the recommendations are appropriate for Danish companies comply with Danish and European Union company law and are recognised as best practice. Throughout the year ended 31 March 2021 the board was compliant with the UK Corporate Governance Code and the King IV Code in that the majority of the.

Meet a recommendation the board of directors must explain. The UK Corporate Governance Code The Financial Reporting Council FRC has issued a revised UK Corporate Governance Code to. Addressed in the Code.

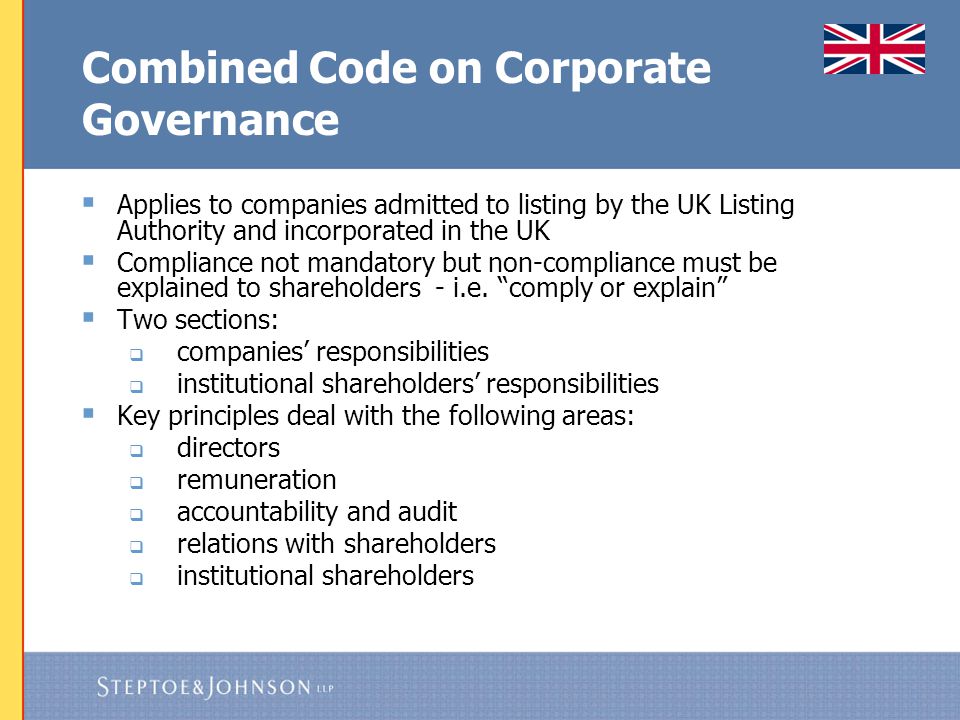

The Code sets out expected standards of good practice in relation to issues such as board leadership and company purpose division of responsibilities composition succession. The UK Corporate Governance Code. UK Corporate Governance Code The UK Corporate Governance Code formerly known as the Combined Code sets out standards of good practice for listed companies on board composition and development remuneration shareholder relations accountability and audit.

The DLC Nomdac considers tenure when examining independence. COMPOSITION 11 The Committee shall be comprised of at least two directors appointed by the Board. The Code does not apply to all companies.

Why it has chosen. Under paragraph 2e of Appendix 23 issuers must disclose the term of appointment of non-executive directors in the Corporate Governance Report. The UK introduced a Stewardship Code for institutional investors.

The majority of the members of the Committee shall be independent within the meaning of 52-110 and the UK Corporate Governance Code 2018 published by the Financial Reporting Council. A key recommendation of the Walker Report a review of corporate governance of the UK banking industry is that. A copy of the Code can be found here.

The Code was later revised in 20072007 Code to strengthen the roles and responsibilities of the board of directors audit committee and the internal audit function. The UK Corporate Governance Code contains detailed recommendations on board composition including that at least half the board excluding the Chairperson should comprise independent non-executive directors and the Chairperson should be independent on. Against the board recommendation for a resolution the company should.

Our work is aimed at investors and others who rely on company reports audit. Following the Walker review see. The development of the UK Corporate Governance Code an OUT-LAW guide banks and other financial institutions will usually also have a risk committee.

Remuneration audit and nomination. Out in the UK Corporate Governance Code the King IV Code and directive 42018 as issued by the South African Prudential Authority when considering the independence of members of the board. The UK Corporate Governance Code states that.

This information is reviewed annually and was last reviewed on 7. These events saw boards being subject to some blame and in the immediate aftermath of the crisis emphasis was placed on the important role of boards in managing risk. Half for listed companies without controlling shareholders.

Both documents are considerably restructured and updated. Code of Business Conduct - Traditional Chinese. The UK Corporate Governance Code recommends that for companies in the FTSE 350 the Remuneration Committee comprises at least three members who are Independent Non-Executive Directors one of whom may be the Chairman but who.

We promote transparency and integrity in business. The first version of the UK Corporate Governance Code the Code was published in 1992 by the Cadbury Committee. The Afep-Medef Code recommends the following proportion of independent directors on the board of directors.

The recommendations on corporate governance supplement current company law and stock. Senior Vice President General Counsel and Corporate Secretary. It defined corporate governance as the system by which companies are directed and controlled.

The board and its committees should consist of directors with the appropriate balance of skills experience independence and knowledge of the company to enable it to discharge its duties and responsibilities effectively main principle B1. They follow on from the FRCs comprehensive review and consultation issued in December 2017 to ensure that the Code remains fit for purpose. The shareholders role in governance is to appoint the.

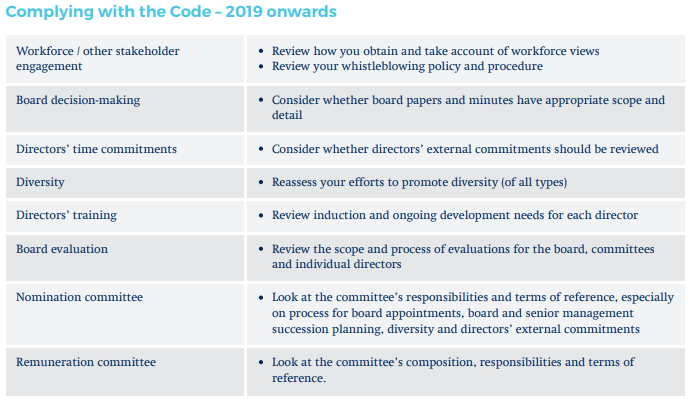

The Financial Reporting Council the FRC has issued its new UK Corporate Governance Code the new Code and revised Guidance on Board Effectiveness the new Guidance. For example board composition board induction and professional development walking the floors staff surveys. Boards of directors are responsible for the governance of their companies.

Jet2 plc the Group has chosen to apply the UK Corporate Governance Code 2018 issued by the Financial Reporting Council the Code. FRC - We regulate auditors accountants and actuaries and we set the UKs Corporate Governance and Stewardship Codes. It is part of a series on corporate governance.

The UK Corporate Governance Code the Code sets out the Principles the board of directors should apply in order to promote the purpose values and future success of the company.

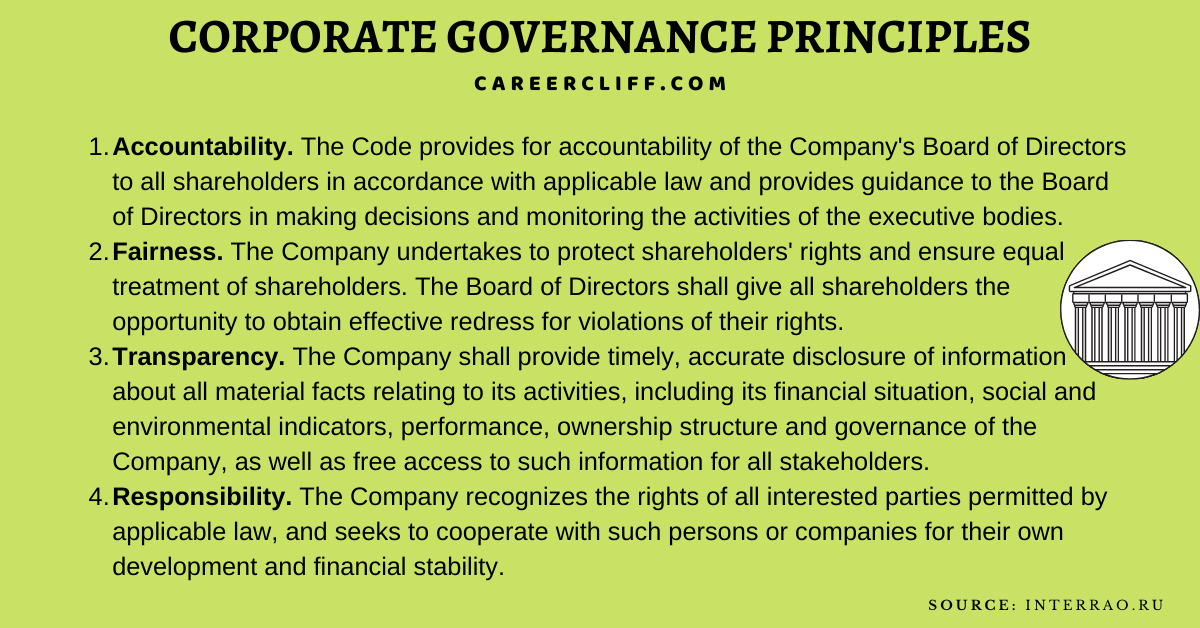

Code Of Corporate Governance Guidelines To Develop Career Cliff

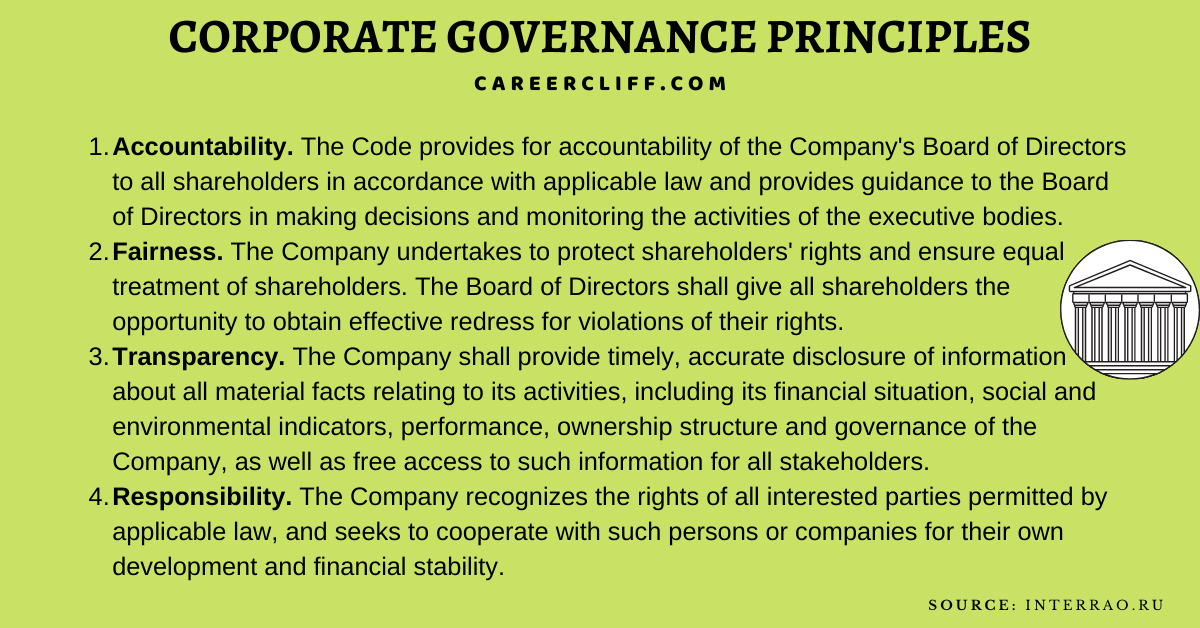

Publication Of The Wates Principles A Defining Moment For Private Company Corporate Governance Lexology

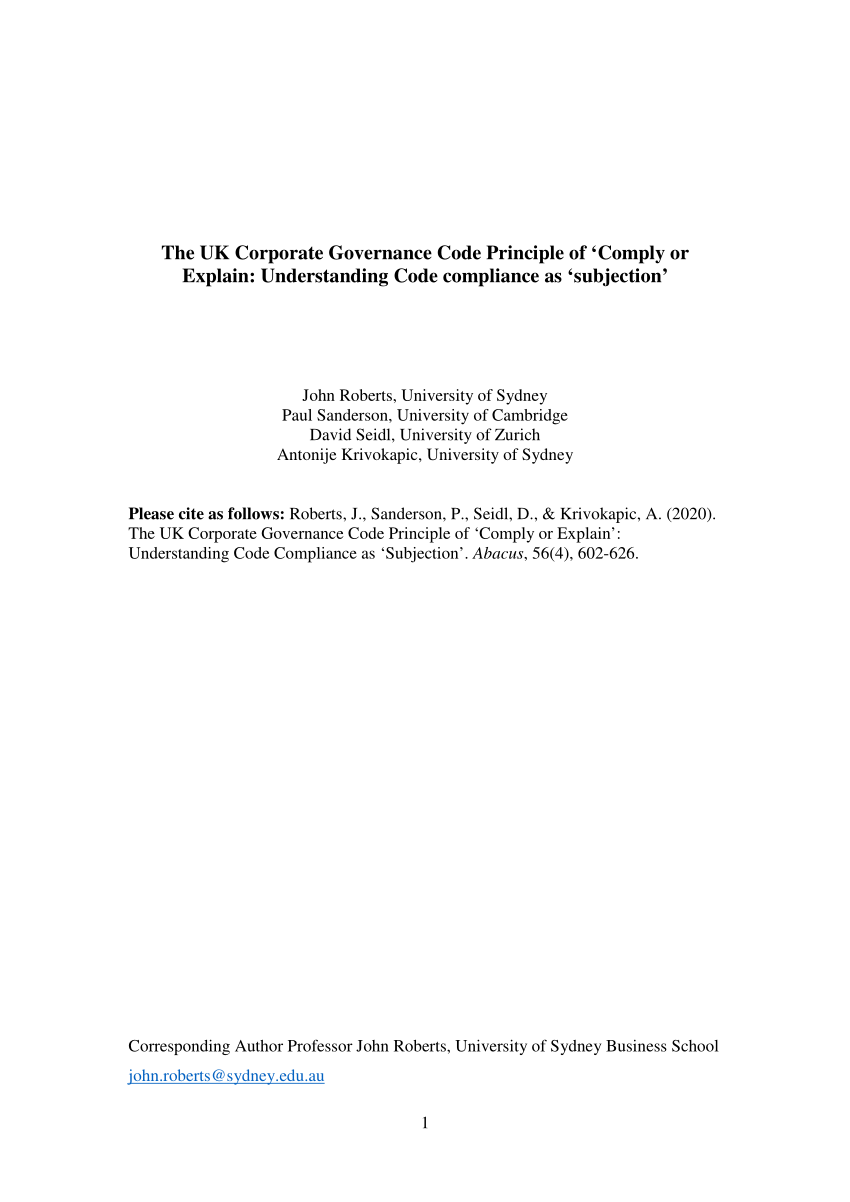

Pdf The Uk Corporate Governance Code Principle Of Comply Or Explain Understanding Code Compliance As Subjection

Uk Six Top Tips For An Effective Corporate Governance Framework

A New Corporate Governance Code For Uk Listed Companies Lexology

What Is Corporate Governance The Uk Government S View Ppt Video Online Download

Code Of Corporate Governance Guidelines To Develop Career Cliff

Logic Discourse And Social Context Of Uk Corporate Governance Download Table

0 Response to "RECOMMENDATION OF THE UK CORPORATE GOVERNANCE CODE ON DIRECTORS COMPOSITION"

Post a Comment